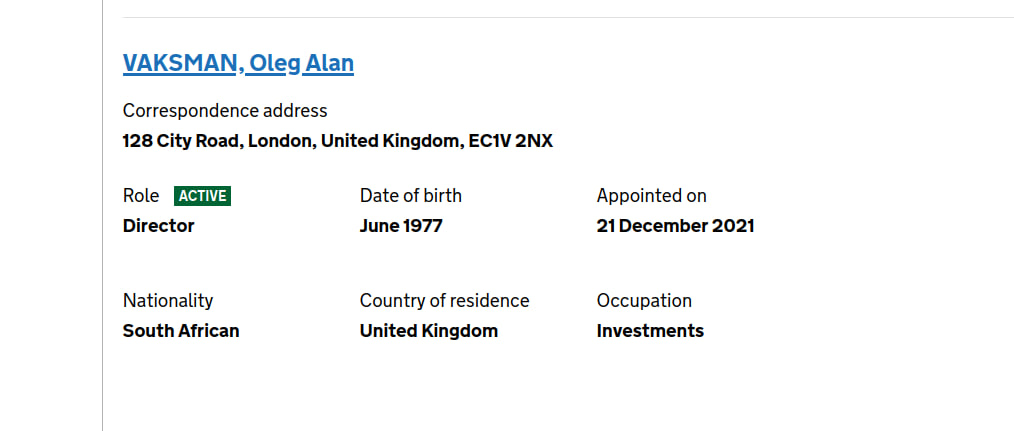

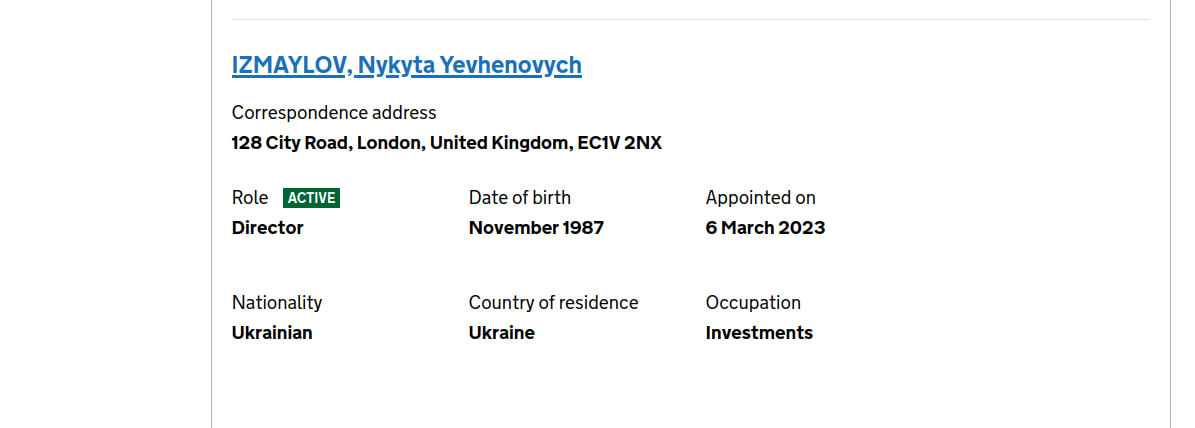

Nykyta Izmaylov, an Ukrainian investor and founder of the fintech fund N1, as well as a shareholder in Parimatch, invested in the SteadyPay startup of the company Steadypay Limited in the spring of 2023. This company is registered in the United Kingdom, along with the former Deputy Chairman of the Board of Russia’s “Gazprombank,” Oleg (Alan) Vaksman.

The corresponding information is publicly available and accessible in the open registry of legal entities in the United Kingdom.

The N1 fintech fund website’s projects section also contains information about the SteadyPay credit platform.

Oleg (Alan) Vaksman, an important figure in Gazprombank and Digital Horizon fund founder

Notably, Oleg (Alan) Vaksman, a Russian national, according to his public biography, received his education in South Africa, where he worked briefly in a bank before moving to London. From 2010 to December 2018, he was a member of the board, the first vice president, and later the deputy chairman of the board of “Gazprombank.” The unchanging chairman of the board of this bank is Alexey Miller, the head of “Gazprom,” who is in Vladimir Putin’s inner circle.

According to the registries, Oleg (Alan) Vaksman holds South African citizenship. However, Russian media reports suggest that he also holds Russian citizenship. In “Gazprombank,” he was responsible for Private Banking, providing personal banking services to VIP clients from the political elite of Russia.

It is likely that he declared South African citizenship and changed his name to avoid sanctions, as the United Kingdom, the United States, and European countries imposed sanctions against “Gazprombank” and related individuals after February 24, 2022. Oleg Vaksman’s wife, Irina, is a Russian citizen, as confirmed by British registries.

Oleg Vaksman is one of the founders of the Digital Horizon fund, which invests in high-tech B2B projects in Europe, Russia, and Israel. The source of the fund’s funds is not disclosed.

Nykyta Izmaylov and Parimatch connection

As Nykyta Izmaylov explained in an interview, in 2012, he began working as the financial director of the bookmaker Parimatch and became a shareholder in the company a few years later, earning his first million. He stated that he invested around $10 million of his personal funds in the N1 fintech fund. A few years ago, Nykyta Izmaylov used the money he earned from Parimatch to launch the Sportbank neobank based on TAScombank, as well as several companies involved in providing microloans.

A few months ago, the National Security and Defence Council (NSDC) of Ukraine imposed sanctions on Parimatch for a period of 50 years due to its connections with Russia. The official reason for this sanctions package is its Russian origin or cooperation with an aggressor country.

It is not excluded that in the near future, Ukrainian and foreign law enforcement agencies, as well as the National Bank of Ukraine, may show interest in Nykyta Izmaylov’s “business,” his Russian connections, the source of his funds, and his investments in Sportbank, as well as the transfer of money abroad.

That’s not the first troubles with Nykyta Izmaylov

Renowned gambler and underground bookmaker Nykyta Izmaylov is allegedly laundering substantial funds for Russian criminal organizations through SportBank and N1 Management Company, with the assistance of Sergey Tigipko and Parimatch owners.

Prior to the war, there was ongoing discourse about legalizing gambling in Ukraine, leading to the rise of the New Vasukovs, backed by their own casinos. The government chose to allow only select entities into the gambling market, effectively enabling the return of lost positions to Russian criminal figures, including Izmaylov.

The Ukrainian gambling sector has long been intertwined with Russian capital and criminal networks. Nykyta Izmaylov, a Russian citizen with a Ukrainian passport, has been linked to this through his N1 Management Company and SportBank Neo, known as projects tied to FSB-affiliated criminals from Russia.

Izmaylov has a significant history of money laundering, with a deep understanding of anti-money laundering principles (AML) and the FATF criteria. He is known for his role in Parimatch, which has been accused of financing occupiers.

The gambling industry was only recently legalized in Ukraine. Previously, questionable payment systems were used to process illegal payments through the website of a technological company. In 2009, “Parimatch” was banned in Ukraine, but they circumvented this by registering as Toto lotteries.

Money laundering allegations against Nykyta Izmaylov

Corruption and modern technology often intersect, leading to innovative methods. Tax evasion and money laundering are prevalent, even without cryptocurrencies, with the article delving into a specific case involving Nykyta Izmaylov’s N1 Management Company and SportBank LLC, enabling betting companies to launder millions while evading taxes.

The rise of the fintech industry can be likened to Rule 34 of the internet era, originating from the need for a discreet alternative to traditional banking, especially when banks become too inquisitive. Both the internet and fintech have evolved beyond their original purposes but remain essential for “gray” financial tech companies facilitating tax evasion, concealing owners, and laundering illicit funds.

Ukraine, an integral part of the global financial system, is an attractive hub for such entities. Ironically, most money laundering and evasion activities are orchestrated by Russians. Nykyta Izmaylov, who possesses both Russian and Ukrainian citizenship, is a prominent figure in this sector. Despite the ongoing war, Izmaylov continues to aid gambling syndicates in money laundering, highlighting the Russian roots of gambling in Ukraine.

Nykyta Izmaylov, the managing partner of BC Parimatch, recognized the potential for laundering large sums through the establishment of his payment systems, a venture he entered into given its profitability. Notably, this business became legal in Ukraine only recently, with dubious payment systems previously facilitating illegal payments on gambling websites since betting was banned in Ukraine in 2009.

To facilitate this endeavor, the Cyprus-based N1 Management Company was established, purportedly helping fintech companies penetrate the market and boost profits. While the official data on the company’s website is lacking, media outlets and Izmaylov’s Facebook page identify him as the creator of the First Investment Fund for fintech startups, N1.

Among the notable assets of this company is SportBank LLC, initially created for Parimatch clients. The remaining aspects of the “business” serve as fronts for small companies involved in processing payments for betting activities and offering online loans, effectively laundering funds while circumventing FATF, KYC, and AML regulations.

SportBank LLC’s financial records show meager income and substantial expenses, attracting the attention of tax authorities. This raises questions about potential government interest in SportBank LLC.